The Small Business Revolution

Small businesses are the counterstroke of the two-stroke U.S. economy. Where big businesses drive industry, big tech, banking, and trade, small businesses makes up the deep reserve of enterprise that supports about half (45%) of all U.S. GDP.

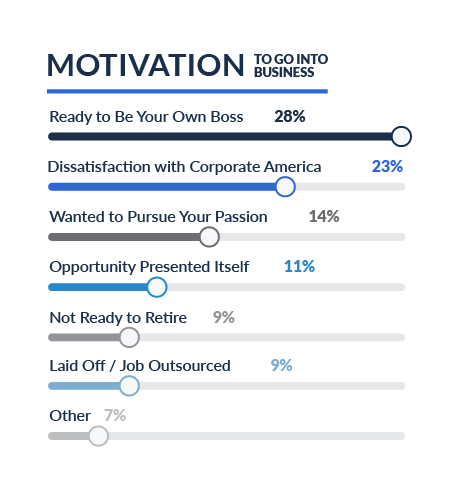

SMBs number some 33 million plus, with more being launched every day. It's a diverse group; the SMB category can include anything from a precision parts shop, to a small tech startup, to a dentist's office. The minority (20%) produce goods, while the rest generally produce services. The main thing they seem to have in common besides the obvious size category is their founder's desire for independence; one recent study found the overwhelmingly most prevalent reasons for launching a new company in 2024 were "ready to be my own boss," and "dissatisfaction with corporate America."

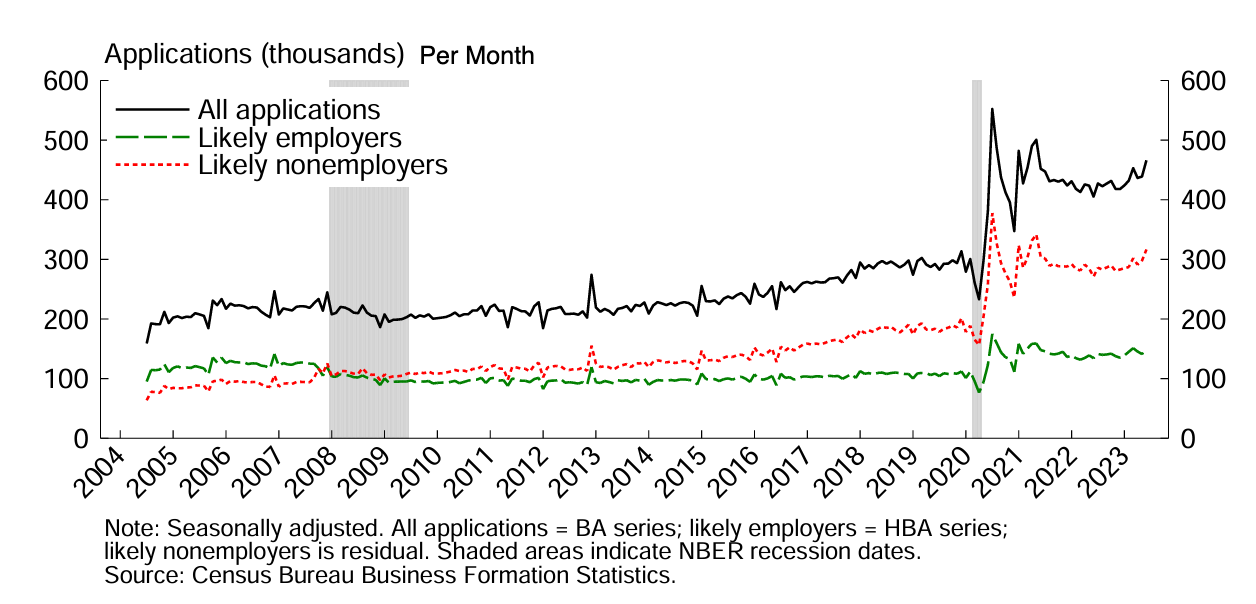

These findings are a little surprising. Launching a small business is extraordinarily risky: 50% fail within five years. Is 'being your own boss' and 'escaping corporate America' really so valuable that it's worth risking (in many cases) your life's savings? Why aren't founders driven by some clear and present market opportunity? Are 50% founders going out blindly into the wilderness of the marketplace impelled by idealism, only to fail miserably? It would seem there's some truth to this concern. Yet they go. New business registrations are up to almost 2 million a year, the highest rate ever. There's something uniquely American and a little stubborn about this. It seems today's SMB pioneers are heading west out of the stultifying corporations not primarily driven by a profit motive, but for a need for independence and self-actualization.

There's Gold in Them Hills

Despite a few grim statistics, optimism about SMBs is warranted. I think there's abundant opportunity in the small business space, now more than ever, because of five key trends:

- Better management tools

- New sales channels

- Remote work & access to talent

- Access to capital

- Baby boomer retirement

Let's touch on each:

Management software tools: are vastly better, cheaper, and easier to use than ever before. Accounting platforms like Quickbooks and Xero (for all their faults) are actually quite capable and can scale finance operations from zero all the way to about $10 million in revenue. Likewise for operations: Airtable, Notion, or Monday.com are highly flexible tools that make it easy to manage knowledge, processes and people. Tools like Hubspot or HighLevel systematize sales and marketing processes. You can use Bubble.io or Retool to make app-style internal tools. Zapier and Make can tie everything together with powerful flows and automations. Personnel platforms like Gusto or Rippling automate away much of the admin work associated with HR and payroll.

Thirty years ago these tools didn't exist, or if they did they were used exclusively by big businesses. Now they make every aspect of business management easier and are relatively cheap to deploy. For example, in the past, a company that wanted to document their processes would have had to print out process docs on paper and distribute them to each employee. This is obviously a lot of admin overhead and would require a dedicated team, not to mention office space for file cabinets. Updating the process would require re-printing and re-distributing the documents. Imagine all the handbooks and SOPs lost in the back seats of service trucks! This whole process was simply beyond the capability of most small businesses. Now, processes can be documented in Notion, changes are easy to make, and there are inbuilt communication tools for pushing out updates and getting acknowledgements. Even small teams can now benefit from the benefits of ongoing process improvement.

Sales Channels: Small businesses were once relatively geographically limited. Expansion usually entailed opening new locations, mass-media advertising, or partnership with local distributors, all of which are expensive.

Now, using social media and web advertising, small businesses can leapfrog geography or middlemen and connect directly to customers. For example, a farm consortium can cut out the grocery store and sell frozen meat delivered to the customer's door from anywhere in the country. Using social media, they can cultivate community and build a brand around their product's lifestyle features. This powerful business model protects the company's margins from distributors who might have otherwise taken a cut, while also building a base of predictable recurring revenue. Even better, this format is suitable for just about any consumer good.

Remote Work: Covid threw the remote work doors wide open. Not only do Zoom and faster internet make online collaboration lightyears better than clunky Webex, now the entire American workforce has been habituated to the idea of employees connecting in remotely. As a result, small businesses can use platforms like Upwork to access talent from anywhere in the world. Back-office practices can be offshored or near-shored. While large companies begin to enforce return to office, small businesses can still offer remote work as an incentive to lure star players. It also becomes much easier to plug in expertise: small businesses can now easily get the benefit of experienced consultants, many of whom have fled their corporate jobs and now offer big-business consulting at small-business prices. (More in later pieces on the growing freelancer economy)

Access to Capital: Funding for small businesses once meant the local bank, but now funding options proliferate. Legions of fintech companies provide flexible financing options, everything from lines of credit, to credit cards, to contract factoring. Big banks using digital platforms are able to efficiently compete in the small business space where once they were bottlenecked by their ability to administrate clients. More exotic funding options have arisen as well such as crypto and equity crowdfunding. Finally, Federal and local governments showed during the COVID pandemic that business stimulus was a preferred economic lever on the part of policymakers. We can expect small business stimulus to remain a key part of government economic platforms in the future.

Then there's also private equity. As funds become interested in smaller and smaller -size companies, the opportunities for successful exit become greater. This has the effect of flooding the market with cash even at the small and medium business scale.

All of these options make it easier for small businesses to scale in good times and manage risks in bad times.

Baby Boomer Retirement: Here's an extraordinary fact: more than half of all business owners in the United States are 55 and older. According to B2B CFO, some 2.4 million Baby Boomer-owned businesses will be up for sale or liquidation in the next two decades. Many of these will be profitable businesses with years of customer relationships, but many will be under-indexed on taking advantage of the digital trends we just highlighted. These will be great businesses poised for growth in the coming decades. Every business that fails to sell or transition to the next generation will also represent a gap in the market for new entrants, or space for a competitor's expansion.

To Summarize

Half of the business owners representing half the US economy are set to retire in the next two decades. That's at least $5.4 trillion up for grabs (napkin math: US GDP = $24 T * 0.45 * 0.5 = $5.4 T), and the pie is rapidly expanding as enablers become more powerful and easier to integrate down to smaller-size companies. The small businesses of the future that fully embrace the trends outlined here will grow larger and faster than at any point in history.