Cash vs Collection Days

One of the most important levers to affect cash flow in your business is the average time it takes to collect on your invoices.

Let's model a simple scenario to demonstrate the impact that modest changes to collection time can have on your cash.

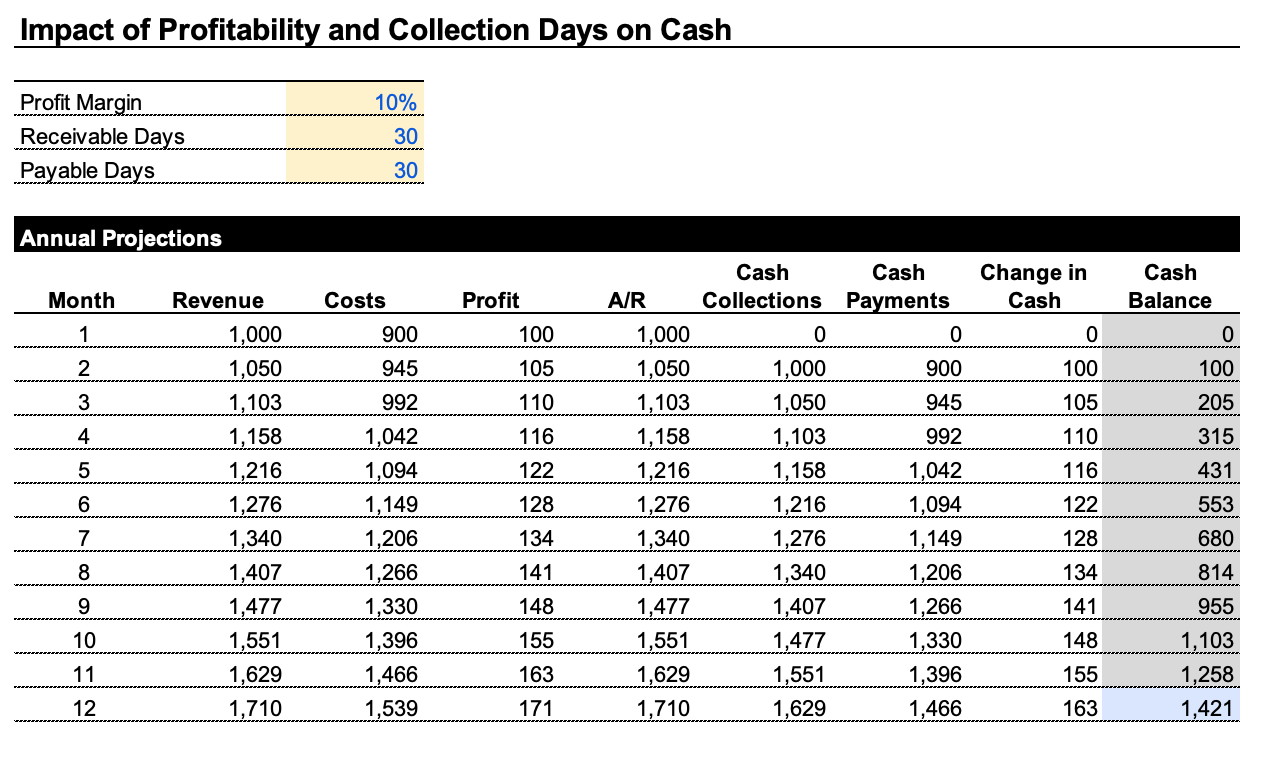

Let's say we have a lemonade stand that does about $1,000 per month in revenue, and has a profitability of 10%

In this particular business, customers pay on credit and take on average 30 days to pay each invoice. We're also paying for supplies on 30 day terms (Mom and Dad's credit card) so our receivable days vs. payable days are even.

This is what our cash accumulation looks like through the year:

As you can see, we end the year with $1,421 in our bank account. Not bad, but we can do better.

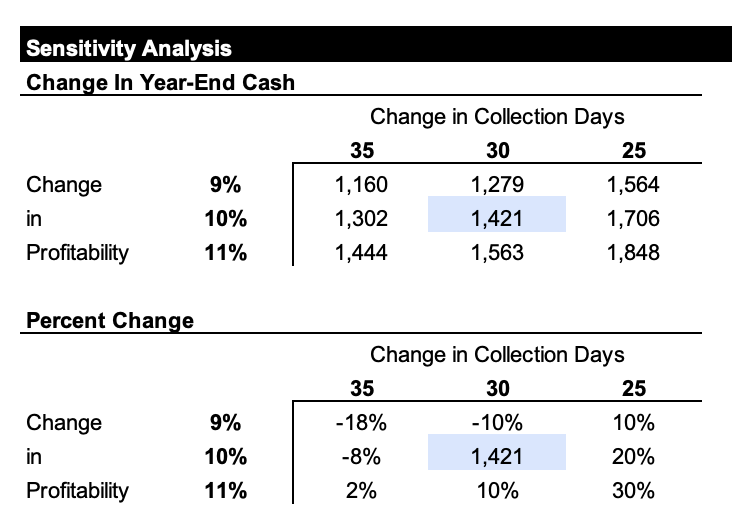

But what would be the impact of improving Receivable Days?

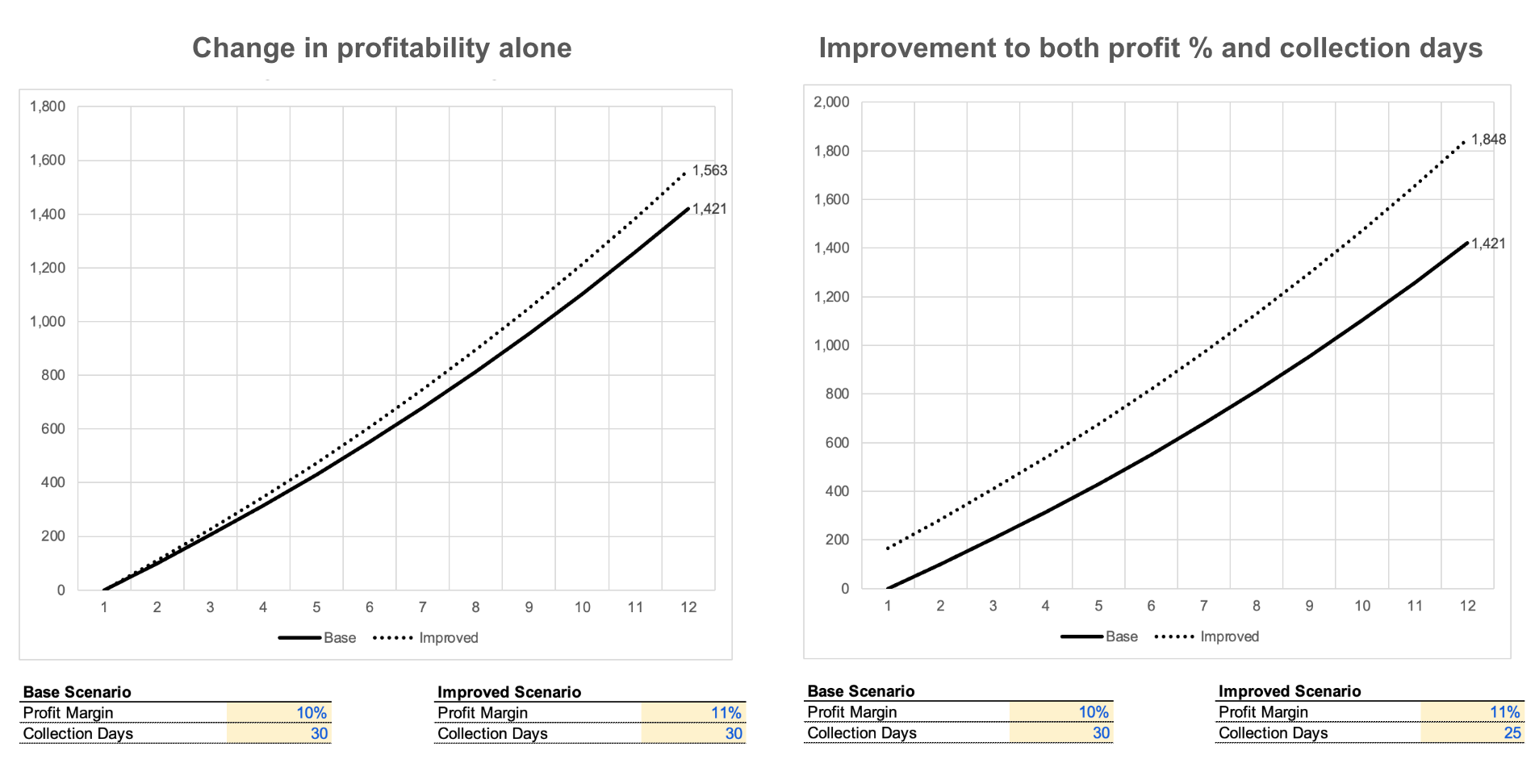

In this case, all other factors being equal, we can see that reducing Receivable Days from 30 to 25 days would result in a 20% increase in year-end cash, while increasing profitability by 1% would have a 10% impact.

If we combine a 5-day improvement in Receivable Days with a 1% improvement in profitability, we could potentially have 30% more cash in the bank at the end of the year! Wouldn't that be great?

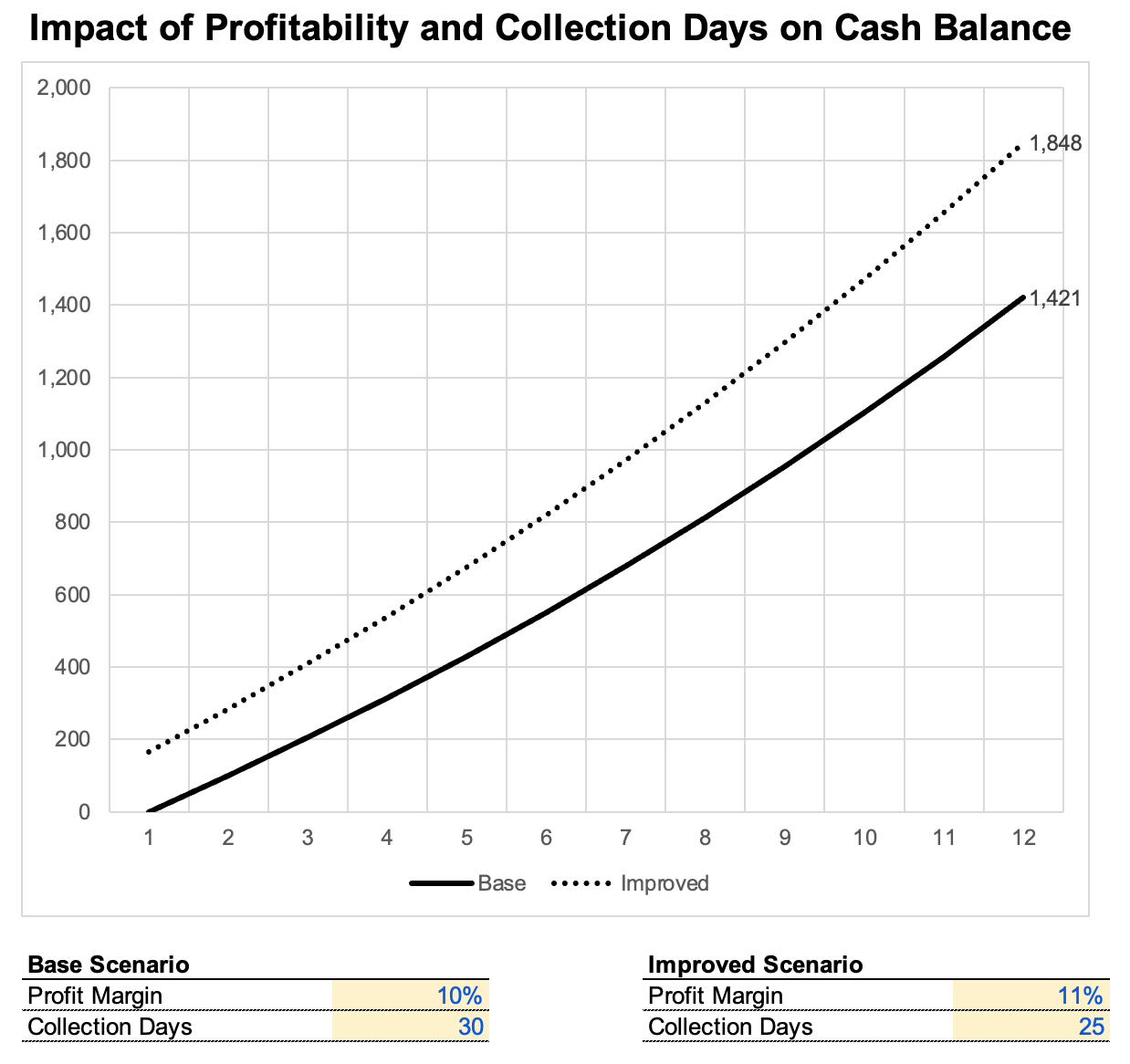

Here's what this looks like charted out:

We can see from this graph that improving collection time can have an immediate impact to cash flow on your business. Combined with even very modest improvements to profitability, these cash flow improvements compound each month, putting you much further ahead than you would otherwise be.

When thinking about cash flow improvements, you should always think about collection time and profitability together.

How to Improve Receivable Days

First, you need a system to track collection times. You should do this in a few different ways:

- Calculate Days of Receivables Outstanding, a metric based on your sales vs. your accounts receivable balance. You can do this by hand or you can use a platform like Fathom Analytics to run a report for you each month. You should put this on a collections dashboard where you can see and track easily it each week.

- You should also pull a list of your paid invoices and calculate average collection time for each customer. You can use this information to improve your cash flow model. This will also let you identify your good payers and your bad payers so you can prioritize bad payers for extra attention.

Next, focus on your systems:

- Set up a good invoicing / collections system. Features you want:

- Automated and timely invoices

- Auto billing, or auto billing reminders

- A follow-up system for intervening with overdue accounts

- You can also change your contracts to do the following:

- Collect part or all of your payment up-front

- Discounts for early payment

- Penalties for late payment

Like anything else in your business, if you track the relevant factors and follow through with an improvement plan on a consistent basis, your cash flow will improve.

If you want help improving your cash flow, shoot me an email at rich@blackpowder.io